By Edmit College Planning

Key Takeaways:

- Start with the full cost – including all categories of expenses.

- Then, look for your “free money” – money you won’t have to earn or pay back.

- Subtract to see your “net price” – what you’ll have to cover using savings, income, or loans.

- Make sure to think beyond the first year of college, as your financial picture can change and you want to be prepared.

Alongside your acceptance letter from your top-choice colleges, you should be looking forward to your financial aid award letter–the document that tells you how much an individual school will cost you to attend (aka your net price), based on the financial aid you receive.

A student (and parents) may find financial aid award letters confusing because they’re not standardized. There’s no template that all the colleges adhere to. As such, your acceptance letter from UC Berkeley may look very different from Berklee College of Music. And after all the stress of studying hard, taking the SAT and ACT, and finally getting in to college, it’s especially frustrating to parse out a confusing financial aid letter.

Luckily, we’re here to help you make sense of your financial aid award letters. Here is a step-by-step guide to get started.

First: What’s the full cost?

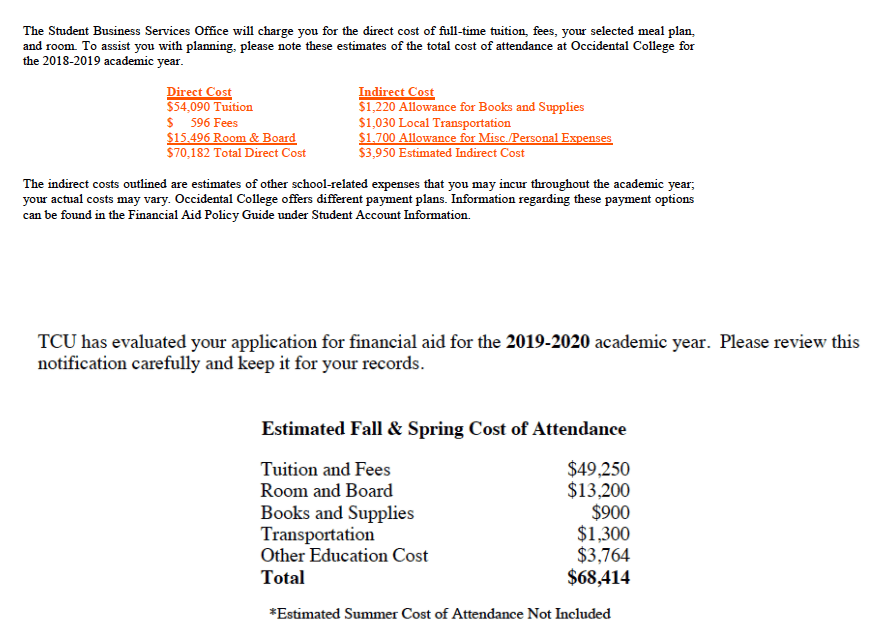

First, find the full published cost of attendance. Note that some schools may not give costs to you in the letter; others might omit personal expenses from the calculation, and some will enumerate everything. Attempt to find figures for every cost category, including fees.

Remember: the full cost of college should include:

- Tuition and required fees

- Room and board

- Books and supplies

- Other expenses (travel, personal expenses, etc.)

Add up the costs for one year at first.

Words to look for: expenses, tuition, fees, room, housing, meal plan, board, cost of attendance, books, supplies, transportation, personal expenses, direct expenses, indirect expenses

Example: Occidental broke out the “direct” and “indirect” expenses in the below letter (to do this analysis, we would recommend adding those numbers together to get $74,132 as a total cost), while TCU adds everything up for you. Be warned… some colleges may not include any costs!

Second: Are you getting free money in your financial aid package…or not?

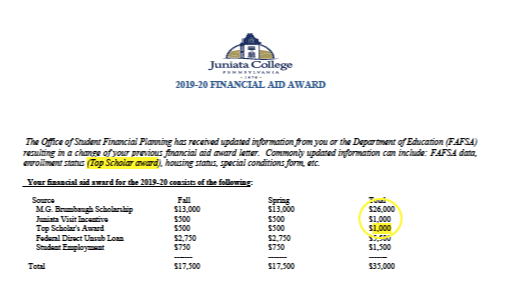

Words to look for: grants, aid, scholarship, merit, award, gift

Look at your financial aid award letter. For every line item, ask yourself, “Is this free money?” “Free money” does not need to be earned or paid back. Make sure to check whether the amount shown is for one year or for multiple years.

Example: this student received three different types of “free money” from Juniata College – one is called a “scholarship,” one is an “incentive” and one is an “award” – which add up to $28,000 per year. While the “Total” line reads $35,000, that number includes a loan and wages (neither of which is “free money”).

Your “free money” may be calculated based on your financial need or on other factors.

Need-based financial aid is awarded to students based on financial need and their inability to afford the college sticker price. Eligibility for need-based aid is determined via the FAFSA or CSS Profile, depending on the institution. Most often these awards are called “grants” or “aid” whether awarded from the federal government (federal Pell Grants) or from the university or college itself.

Merit aid is awarded on the basis of other characteristics. The most common reason you’d get merit aid is if your grades, test scores, or extracurriculars are above the college’s standard. But there are many factors – sometimes it’s more like a standard discount, or other times colleges are using merit aid to shape their class.

Both need-based aid and merit aid come in a variety of packages and can be called different things. Either way, it’s free money – but it’s helpful to try to understand which one it is. More on why below…

Third: Making up the difference

Your net cost is the amount you need to contribute on your own, assuming you don’t submit a financial aid appeal letter and then get more financial aid. Once you have your specific net cost you have to think about how you’re going to pay it. Aside from savings that you might have, here are a couple of ways to cover your net cost of college (note that some of these “not-free money” items may be on your award letter):

Student Loans

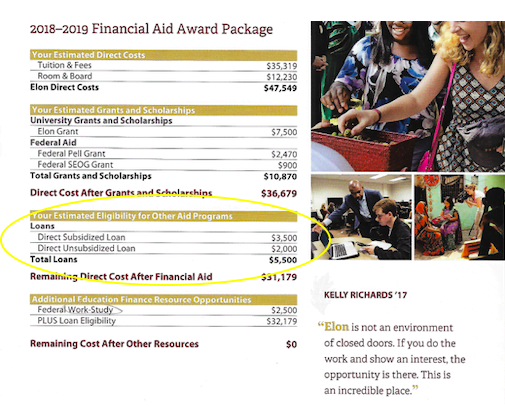

Words to look for: direct, loan, sub, unsub, federal, PLUS, Stafford, self-help

Federal student loans are sometimes listed in financial aid award letters.

No matter the type of loan, they must be paid back in full, with some amount of interest. Federal loans are subsidized (which means the loan will not accrue interest while the student is in college) or unsubsidized, and come with their own terms.

Federal loans in your financial aid letter are available to you – but you do not need to take them, or to take all of the amount listed. You can decide later in the process what size loan you will need.

Example: this student qualifies for $5,500 in federal loans for her first year of college. Some of that is subsidized and some is unsubsidized. If she accepts the unsubsidized loan there will be interest charged every year on that amount.

Private student loans are available for college, but will not be listed in your financial aid letter. You will seek and apply for those once you have decided on your college choice.

Federal Work-Study

Words to look for: work-study, self-help

A work-study program indicates you’ll be able to get a job on campus and earn money. If you qualify, the amount that is available for you to earn would be included in your financial aid award letter. Keep in mind that being eligible for a work-study job may not be a guarantee that you’ll find a job you want with the right schedule for you. You will still need to search and apply for the job yourself (and keep it!).

Even if you don’t see work-study on your financial aid letter, you are still free to seek on-campus jobs or off-campus jobs to contribute to your college costs.

Fourth: Think ahead

Before committing to a particular university or college, you should feel comfortable that a combination of your savings and contributions, student loans (at a reasonable level), and the work-study job or employment you can find during school can sustain you and meet your net cost of attendance. Build your annual budget – taking any special circumstances into account–and make sure the numbers add up.

This is important: college is more than a year! It’s usually at least four to get a bachelor’s degree, and every year has tuition and costs associated. Think about changes year to year with inflation. The school tuition can change and is likely to, though some schools freeze tuition or commit to making up the difference in financial aid. (Check your financial aid package or ask the college’s financial aid office.) In the case of work-study jobs, the time you have to work or the work-study jobs available can change. Make sure you know what will it take to maintain your scholarships (e.g., demonstrating your financial need annually or showing satisfactory academic progress by maintaining a certain GPA).

Most financial aid award letters with a need-based aid component have a clause stating that awards are contingent on further verification (even if you haven’t received that request yet). Additionally, need-based aid awarded in future years is likely to require re-verification. So if there’s anything that has changed in your financial situation as represented in your FAFSA, you’ll want to make sure you think about the impact on your financial aid awards.

Last: Don’t stay in the dark!

Still confused? Always ask questions if something is not clear. Get in touch with the financial aid office of your specific colleges. You have the right to understand every component of your financial aid award letter!