Convenience Services

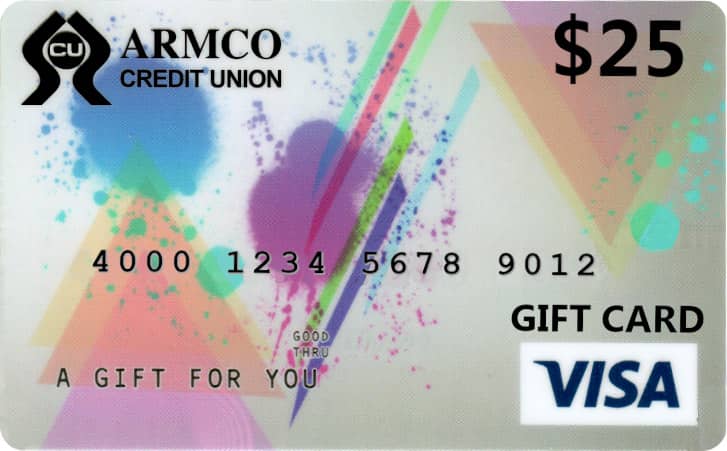

Visa® Gift Cards

- Use almost anywhere – Unlike gift cards for a specific store, Visa gift cards can be used at merchants throughout the United States. They can even be used to order an item online or by phone.

- Safe & Convenient – Visa gift cards are safer to carry than cash and easier to use than a check.

- Secure – Visa gift cards offer Visa Zero Liability on fraudulent activity for signature- based purchases

- Visa gift cards – are available at any Armco CU branch for a $2.50 fee per card. Load one time from $10 – $1,000. Many card images to choose from.

Coin Machine

The old days of sitting down with a big jar of change and counting it for hours is gone. Armco CU offers a FREE coin machine that counts your change in minutes so you can get back to the important things in life. A coin machine is located at the Butler and Mars branches and is free for member’s use.

link

Overdraft Protection

Avoid bounced checks with your choice of automatic Overdraft Protection options.

- Standard Overdraft Protection – Draws from your savings or other predetermined account in the event your checking account is overdrawn. This type of transaction has a $7.50 fee, but will save you a $25 non-sufficient funds (NSF) fee.

- Personal Line-of-Credit – When you use your Personal Line-of-Credit, you pay only interest on the amount transferred to cover the check amount, avoiding the $7.50 overdraft fee and the $25 NSF fee.

- View our fees here

Instant Issuance

Your Card Is Ready When You Are!

Instant issuance is a convenience service that allows members to receive a new or replacement debit or credit card in less than 15 minutes! No more waiting for your card to arrive in the mail – simply visit our Butler or Mars branch and walk out with your new card in hand.

- New accounts receive a card at no charge.

- Cards compromised with fraud will be replaced at no charge.

- Lost or damaged cards will be charged $8.00.

Instant Issuance is available for all plastic consumer and business Mastercard® Debit Cards and Cashback Rewards Visa® Credit Cards.

Please note: Instant Issuance is only available in person at our Butler or Mars Branches. Due to the possibility of mail fraud, we are unable to mail new cards. If you are unable to visit these branches, you may order a new card from our card processor at https://www.armcocu.com/card-orders. Cards arrive within 7 to 10 business days.

Payroll Deduction

- If your employer is one of our sponsor organizations, you can have a portion of your pay automatically deducted to pay a loan or fund a savings or IRA account. Contact your HR department or contact Account Servicing to determine the method that works best for you.

- If your employer is not one of our sponsor organizations, we can create a transfer to occur on a regular basis (ie: weekly, biweekly, monthly). Ask your employer to consider becoming one of our sponsor organizations by calling our marketing department at 724-284-2020 ext. 1046. – it does not cost your employer any money and allows your co-workers to become eligible to the credit union.

Certified Checks

For situations where immediate funds availability is required.

Fee Assessed

Money Orders

Available in amounts up to $1,000.

Fee Assessed

U.S. Savings Bonds

Savings bonds can be redeemed at the Credit Union, but can only be ordered online directly from the U.S. Treasury. The latest market-based rate information is available 24 hours-a-day by calling toll-free, 1-800-US BONDS, or by visiting the website www.savingsbonds.gov.

Wire Transfers

Wire transfers are available for incoming and outgoing funds, for domestic and international transactions.

Fee Assessed